In the grand economic theater from 2018 to 2022, the global human hair extension market has not merely weathered the storm but sailed through it with audacity and grace. Amidst the tempest of the COVID-19 pandemic and economic headwinds, this sector has emerged not just unscathed but fortified, showcasing an inspiring saga of resilience and innovation. In this analysis, we’ll navigate through the intricate import and export data streams, unveiling the potential golden opportunities for businesses within the human hair extensions industry’s vibrant horizon.

Global Hair Extensions Market Trends Analysis

Global Demand Trends

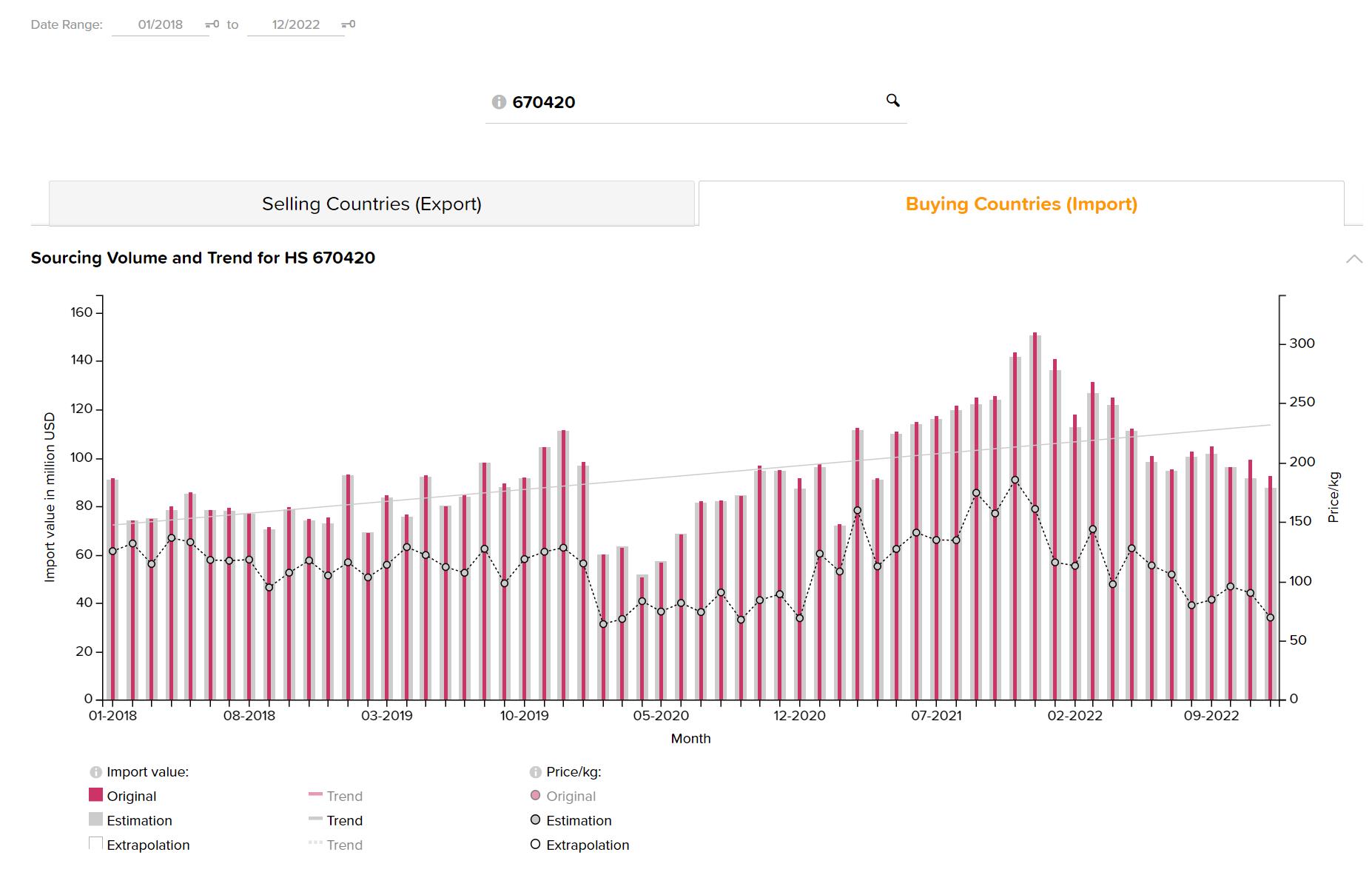

The import data for human hair extensions under HS code 670420 from 2018 to 2022 shows a strong and growing demand within the importing countries, as indicated by the overall increase in import values. Despite price fluctuations per kilogram suggesting shifts in consumer preferences or production costs, the market has demonstrated resilience, particularly with a recovery after an initial downturn due to the COVID-19 pandemic. The aggressive sourcing of human hair extensions can be attributed to renewed consumer confidence, the reopening of salons and social events resuming, pointing towards a stable market recovery and a positive future outlook.

Supply Dynamics

Between 2018 and 2022, exports of human hair extensions, coded HS 670420, have shown a consistent upward trajectory, highlighting an expanding global market. The industry adeptly navigated through the disruptions caused by the pandemic, exhibiting a remarkable rebound, especially following the initial shock in early 2020. The fluctuating export prices suggest an industry responding to shifts in production costs, consumer taste, and hair quality standards. Data projections indicate not just a recovery but a thriving sector with the agility to adjust to changing market demands, emphasizing the industry’s capacity to sustain growth and expand its global footprint in the hair extensions market.

Hair Extensions Market Analysis of Major Importing Countries

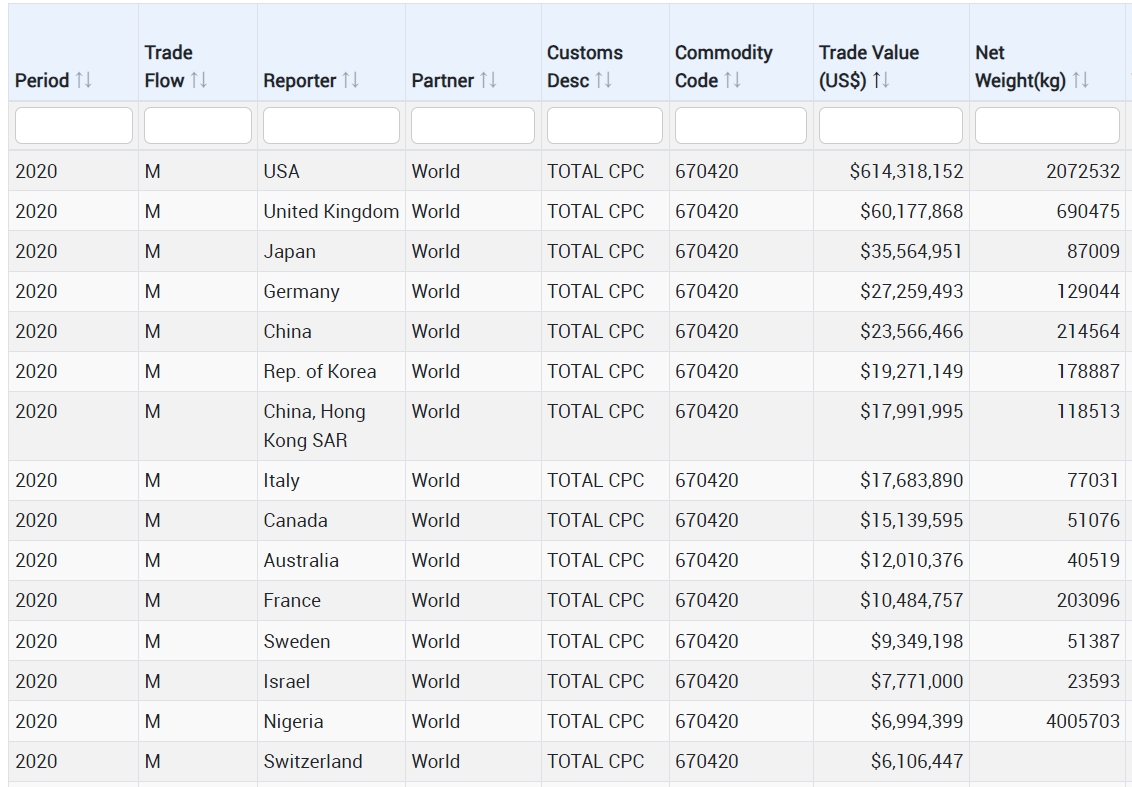

United States: The Market Behemoth

The United States has consistently dominated as the primary importer in the hair extensions industry. From 2018 to 2022, despite the global disruptions caused by the pandemic, the U.S. market exhibited not only resilience but also significant growth, with import values peaking over $1 billion in 2021. This growth trajectory underscores a solid consumer base with a sustained appetite for hair extensions. New entrants targeting the U.S. market should focus on understanding the nuanced needs of diverse consumer groups and leverage digital marketing strategies to tap into this robust market.

The United States has consistently dominated as the primary importer in the hair extensions industry. From 2018 to 2022, despite the global disruptions caused by the pandemic, the U.S. market exhibited not only resilience but also significant growth, with import values peaking over $1 billion in 2021. This growth trajectory underscores a solid consumer base with a sustained appetite for hair extensions. New entrants targeting the U.S. market should focus on understanding the nuanced needs of diverse consumer groups and leverage digital marketing strategies to tap into this robust market.

United Kingdom: A Stable Contender

The UK market for hair extensions has shown stability throughout these years. As a mature market, the UK presents a consistent demand profile that can offer predictable business opportunities. Companies entering this market should prioritize maintaining high standards of quality and explore niche market segments that may be underserved.

Germany: Precision in Demand

Germany’s market has mirrored the UK’s in terms of stability and maturity. German consumers place a high value on product quality and sustainability, offering opportunities for businesses that can meet these expectations with precision and innovation.

Japan and South Korea: Cultures of Aesthetics

Japan and South Korea have emerged as consistent top importers, driven by a strong cultural focus on personal grooming and the influence of beauty trends, particularly the K-beauty phenomenon. Products that align with these countries’ beauty standards and trends can resonate well in these markets.

Italy and France: The Fashion Forward Markets

Italy and France, with their fluctuations, signal markets that are responsive to trends and innovations. These countries, with their rich fashion heritage, offer an avenue for premium, trend-setting hair extensions. Businesses should focus on high-quality, stylish products and build partnerships with local fashion industries to make inroads into these markets.

Emerging Markets: Poland and Australia

Poland and Australia, though newer and less consistent in the rankings, represent emerging opportunities. Their fluctuating presence indicates a developing consumer base and potential for market growth. For new businesses, these countries could be less competitive and offer a first-mover advantage if they can identify and fill gaps in consumer needs.

Adapting to Market Sensibilities

Understanding the cultural sensibilities and consumer behaviors in these diverse markets is crucial. Companies that can cater to the specific tastes and preferences of each region, whether through product differentiation, targeted marketing, or localized branding, stand to gain a competitive edge.

Strategic Positioning for New Entrants

New entrants must strategically position themselves by offering differentiated products, engaging in local market trends, and adopting sustainable practices that appeal to the environmentally conscious consumer. Embracing digital transformation and e-commerce will be vital to capturing the tech-savvy segments of these markets.

Hair Extensions Market Analysis of Major Exporting Countries

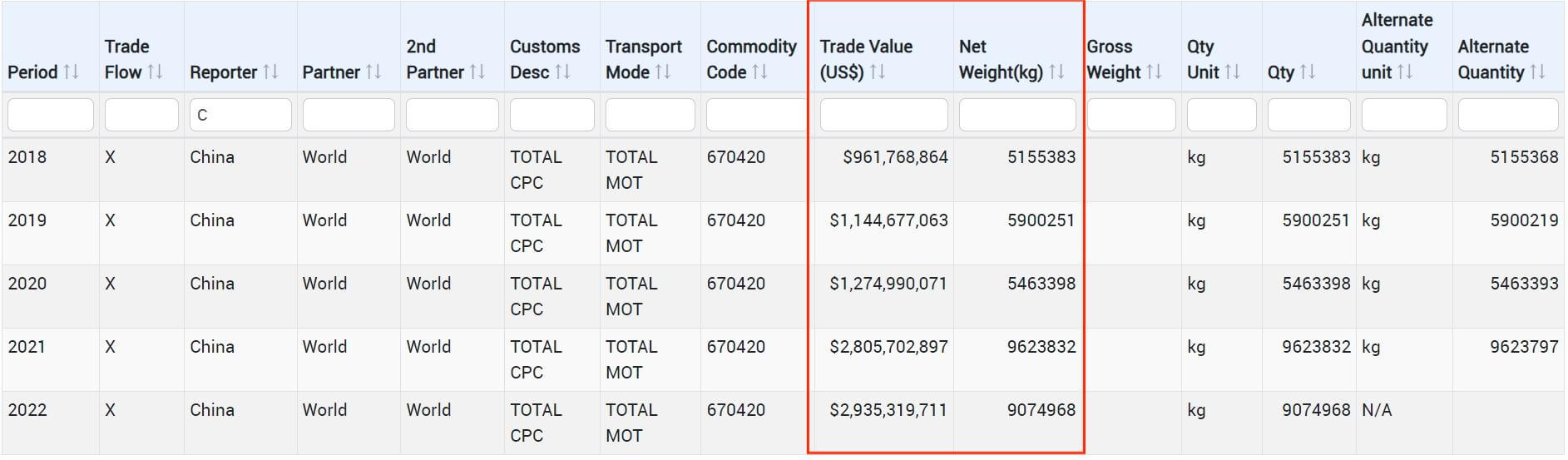

China: The Global Powerhouse

China’s export data likely reflects its status as a manufacturing giant. With export values rising over the years, it shows China’s significant role in supplying the global demand for hair extensions. The year-on-year increase in trade value indicates an expanding market reach and suggests that China has a well-established infrastructure and supply chain capable of meeting large volumes demanded by the market.

China’s export data likely reflects its status as a manufacturing giant. With export values rising over the years, it shows China’s significant role in supplying the global demand for hair extensions. The year-on-year increase in trade value indicates an expanding market reach and suggests that China has a well-established infrastructure and supply chain capable of meeting large volumes demanded by the market.

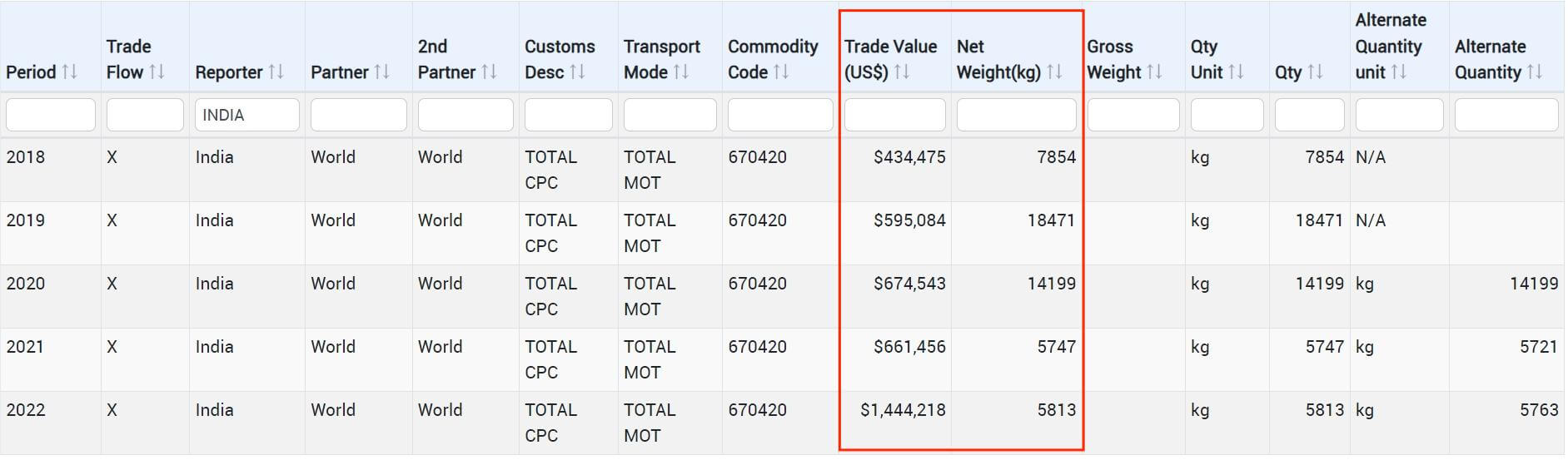

India: The Quality Supplier

India is known for its high-quality hair extensions, often sourced from the temples as part of cultural practices. The export data might show a steady increase or stability in trade values, highlighting India’s strong position in the industry as a provider of premium products.

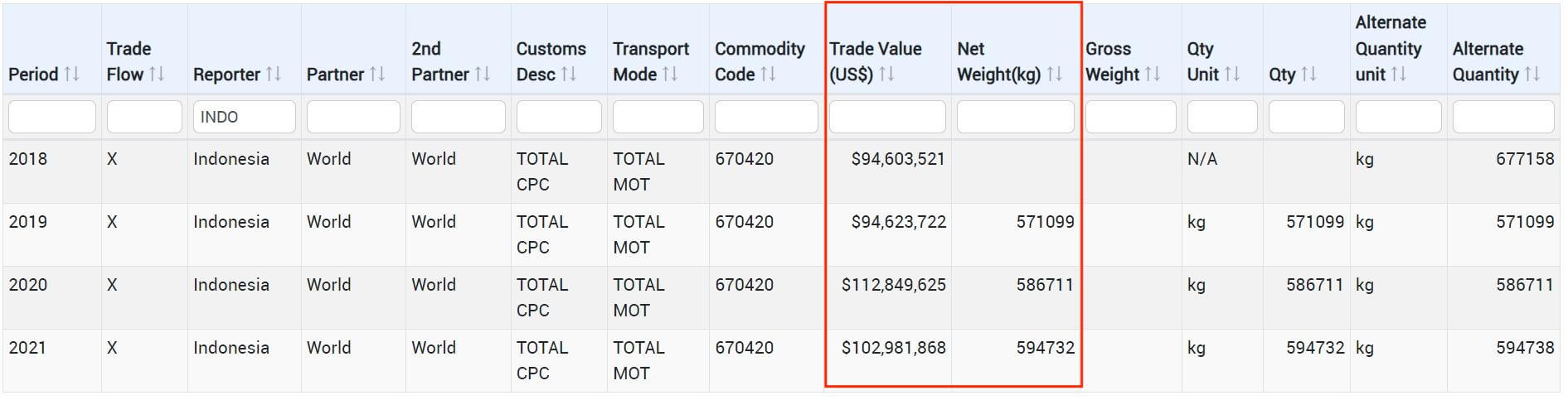

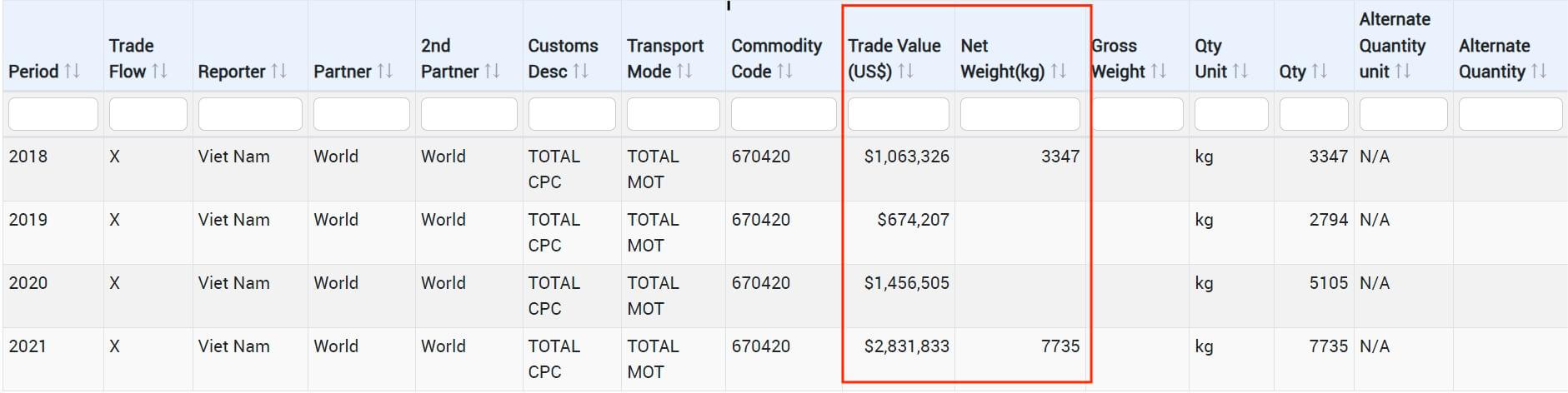

Indonesia and Vietnam: Emerging Contributors

Countries like Indonesia and Vietnam might show varying trends in export values. Any upward trends in export figures can suggest these countries are becoming more significant players in the hair extensions market, possibly due to improvements in manufacturing capabilities or an increase in global market penetration.

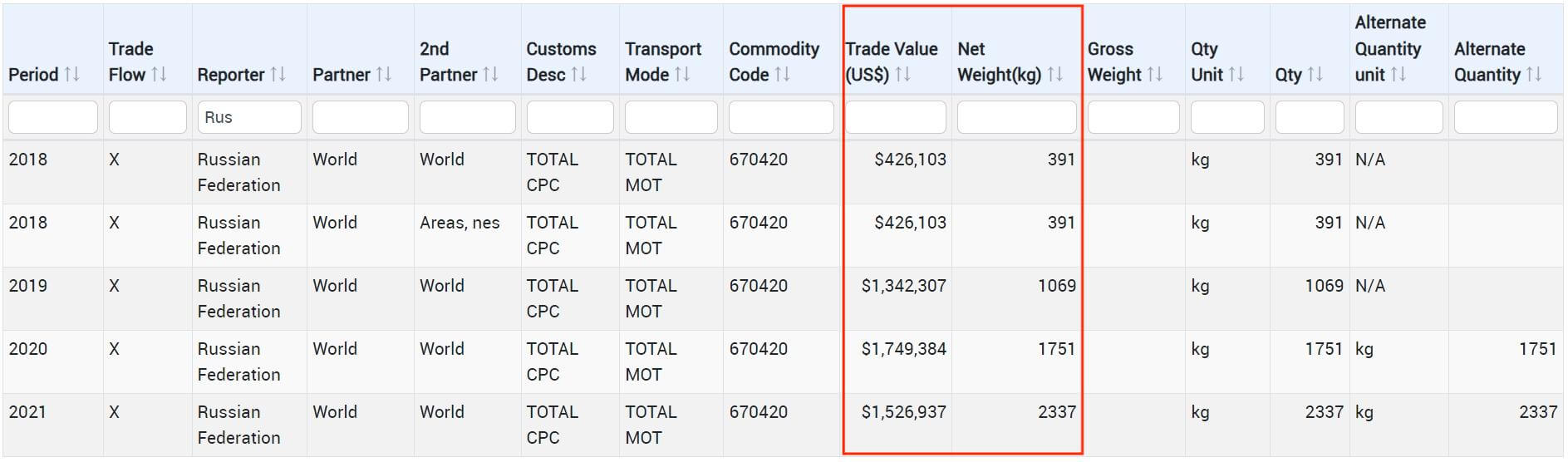

Russia: The Niche Market

Russia’s figures, possibly smaller in comparison, could indicate a niche market. Any growth trends may suggest an increasing recognition of Russian hair extensions for their quality or distinctive characteristics.

Implications for New Entrants

For new businesses entering the hair extensions industry, these export trends offer valuable insights:

- Sourcing from China and India could be beneficial due to their established markets and reputations for quality and volume.

- Partnering with emerging markets like Indonesia and Vietnam might offer competitive pricing and new types of hair extensions to diversify product offerings.

- Exploring niche markets such as Russia can differentiate a new business by providing unique products that may command higher prices.

New entrants should conduct thorough market research to understand the quality, types, and pricing of hair extensions that these major exporters provide. Understanding these dynamics is essential for positioning their products appropriately in the market, whether competing on price, quality, or unique selling points.

Conclusion

In conclusion, the hair extensions industry’s landscape from 2018 to 2023 presents a myriad of opportunities for new entrants, shaped by the robust demand in established markets and the emerging trends in developing regions. The consistent growth in the U.S. market, the mature stability of the UK and Germany, and the flourishing markets of Asia highlight the diversity of consumer needs. Emerging markets like Poland and Australia offer fresh terrain for growth, while China and India’s export dominance underscores the importance of sourcing and volume. For new businesses, success will depend on a strategic blend of quality sourcing, market-specific innovation, digital savvy, and sustainability—a formula that promises to turn the tides of challenge into waves of opportunity in the dynamic arena of hair extensions.

(Note: For comprehensive insights, we recommend a closer examination of the datasets provided by comtradeplus.un.org.)